WHAT IS HOUSING MITIGATION?

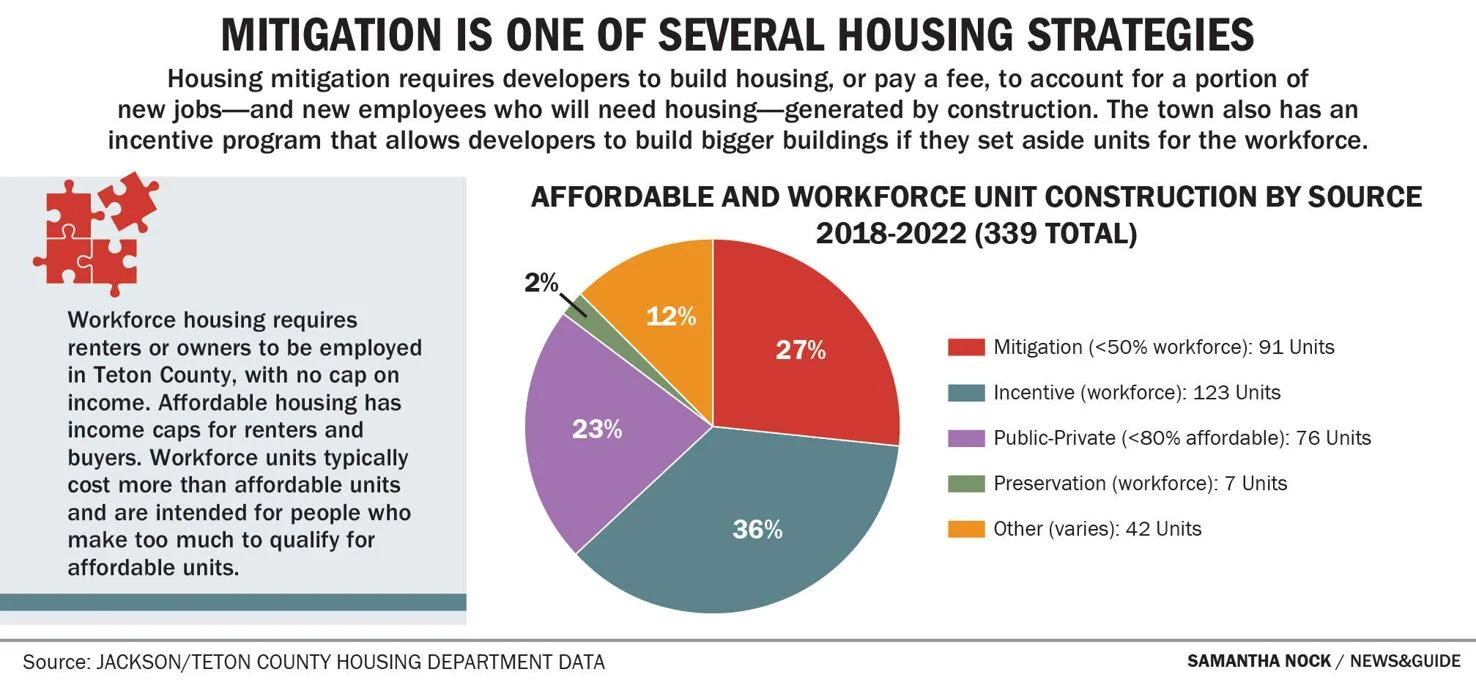

Housing mitigation is a regulation that “ensures that affordable workforce housing is provided by developers proportionate to the impact on the need for housing their development creates.” Mitigation is based on the fact that both commercial and residential development either directly or indirectly create new local jobs and therefore an added strain on our limited housing supply. Different rates are applied to different kinds of development.

WHY SHOULD WE CARE?

The housing mitigation program is one essential piece of addressing the housing crisis in Teton County. Taxpayers and non-profits cannot fund the construction of deed-restricted homes alone—developers play a huge role in creating demand, so they also need to be mandated to create homes. Mitigation rates were last updated in 2020, so it is critical that we update them considering the significant changes since then.

There are specific aspects of housing mitigation that electeds are considering changing in 2023, including:

- Increasing the costs of fee-in-lieu mitigation so fees are proportionate to construction costs; or increasing them to disincentivize developers paying a fee instead of constructing homes

- Reducing the different categories of mitigation rates to simplify the program

- Eliminating the fee associated with “change of use” i.e. a property switching from residential to commercial

OUR POSITION

It is essential to increase housing mitigation rates to ensure developers are participating meaningfully in providing homes for the workers their projects necessitate. One of the main reasons we have a sizable stock of affordable/workforce housing is that developers have provided homes as part of their developments. Lacking this tool, we has fewer opportunities for locals to live locally. Many businesses and individuals benefit from publicly-funded housing (see the list of businesses starting on page 34 here).

We have been working on this issue since 2018 when we penned our first comment letter to the Town and County. We want to see updates to our mitigation rates to address our deepening housing crisis while protecting the economy. We also understand that mounting fees stifle economic growth, so we support a balanced approach to levying fees.

Kelsey Yarzab, ShelterJH Policy Chair, wrote a Guest Shot on housing mitigation published on 10/11/23 here.

WHAT’S NEXT?

The Town Council and County Commission have held several joint meetings to discuss potential changes to the mitigation program based on the latest Housing Nexus Study. We can expect these discussions to continue before they culminate in a potential recommendation to alter the current housing mitigation program. There will also be a public review process as meetings unfold.

A local family is suing Teton County over the mitigation program. The County Commission filed a motion to dismiss this case as mitigation fees are based on a Nexus Study which has held up in court repeatedly. Stay tuned for more updates!

HISTORY

See the timeline below for an in-depth look at housing mitigation changes over the last three decades. This article also shares a succinct review of housing mitigation in our community.

HOW CAN I GET INVOLVED?

Make sure your Town Councilors and County Commissioners (council@jacksonwy.gov, commissioners@tetoncountywy.gov) know that you support updated mitigation rates.

We’ll update you about opportunities to get involved, and you can also watch the schedule here.

Although approaching representatives can be intimidating, remember their job is to listen to you!

FAQS

What is the Housing Nexus Study?

The Town Council and County Commission hire consultants to conduct a Housing Nexus Study. This research determines the number of employees generated by different kinds of development and the necessary subsidy to house them. Electeds use these studies along with consultant recommendations to rationalize and inform housing mitigation policy.

Why did electeds choose to reduce mitigation rates in 2020?

Unfortunately, local interest groups have traveled to Cheyenne in an attempt to circumnavigate our local decision-making processes and make housing mitigation illegal throughout the state. JH Working associates made this move in 2019, which prompted the mitigation rate reduction in 2020. As we consider increasing rates, we need to be mindful of potential statewide action that could undermine these choices; however, we still think it is essential to figure out a way to raise rates to support the employees that enable our community to survive.

Can you share more about the importance of local control?

The Editorial Board at the JH News & Guide published a piece on local control amidst the Regulatory Reduction Taskforce meetings here.

GENERAL TIMELINE

1994: New regulation that requires developers are to offset the jobs created by their projects

2018

- 7/16/18: Town and County decide to raise housing mitigation rates significantly based on 2013 Nexus Study

2019

- 9/16/19: JH Working meets with state delegation in unofficial convening about housing mitigation

2020

- 10/13/20: Town and County direct staff to reduce non-residential mitigation by 50%

- 10/21: Proposed mitigation updates in the LDRs presented to Town and County

- 11/23: County Planning Commission reviews updated mitigation rates

- 12/15: County Commission hearing on updated mitigation rates

2021

- 1/4/21: Updated housing mitigation requirements approved by County Commissioners

2023

- 6/29/23: JH Working holds a forum to discuss housing mitigation

- 7/12-13: Housing Mitigation Joint Information Meeting

- 9/21/23: Regulatory Reduction Taskforce meets in Lander to discuss topics for draft bills

- 10/30/23: Regulatory Reduction Taskforce releases draft bills, including one limiting mitigation fees

- 11/9/23: Regulatory Reduction Taskforce virtual meeting

2025

- 3/7/25: The legislature considered a few bills that would have gutted our local housing mitigation program; fortunately, the tool is safe for now.

- 7/30/25: A local family is suing Teton County over the mitigation program; County Commissioners filed a motion to dismiss the case.

- 9/11/25: County’s motion to dismiss is denied.

Last updated 10/31/25