WHAT IS PROPERTY TAX?

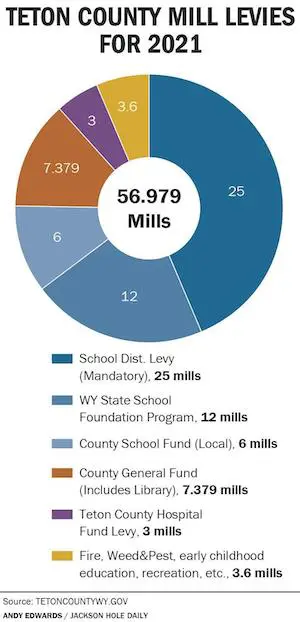

Property tax is assessed on residential and commercial property in Wyoming. County Commissions set rates throughout the state based on mill levies, which corresponds to an amount of tax per $1,000 of value. Teton County property taxes rose an average of 36% in 2022.

WHY SHOULD WE CARE?

Property tax rates have been skyrocketing as property values have been rising across the state. Property tax hikes present a significant issue for many, especially retirees and other folks living on a fixed income. Homeowners are not the only ones who are affected; renters are also experiencing massive rent increases as landlords pass on these rising costs to tenants.

During the 2023 legislative session, property tax hikes became a bipartisan issue. The property tax issue continues to make headlines in Teton County, and it has become especially acute over the last five years.

OUR POSITION

We have heard from our members that property tax relief and reform is at the forefront of their minds. We enthusiastically support property tax relief for local residents who are at risk of losing their primary home. We are especially concerned about those living on fixed incomes who have no ability to afford tax hikes.

In order to combat our revenue shortage, we also want to ensure that we are able to capture tax income from second or eighth homeowners, or other high-income earners who do not need tax relief.

WHAT’S NEXT?

SF 69 just passed in the 2025 legislative session. With the passing of this law, single-family homeowners will immediately see a 25% tax cut applied to the first $1 million of their home’s value.

Check out this article for a full list of bills that addressed property taxes in 2025.

HISTORY

In a state with low overall taxes, no income tax, and no real estate transfer tax, revenue streams are few and far between. Historically, Wyoming schools have been funded primarily by property taxes and mineral/natural resource extraction revenue. With coal demand plummeting, Wyoming is in a budget crisis.

This situation has made it even more difficult for legislators to deliver tax relief to Wyomingites while continuing to fund the state’s essential services. There were some major bills passed in 2023 addressing property tax—see our detailed timeline below for more information.

HOW CAN I GET INVOLVED?

- ShelterJH member Karlene Owens is convening a group at Representative Storer’s request to discuss property tax reform. Please email info@shelterjh.org if you are interested in participating.

- Make sure you are up-to-date with your property tax relief knowledge, and be sure to access those resources if you qualify.

- Contact your local State Representative and/or Senator to let them know how you feel about property tax increases. Find your legislator here.

Although approaching representatives can be intimidating, remember their job is to listen to you!

FAQS

Why doesn’t ShelterJH support property tax caps?

Although property tax caps seem like a simple solution to this issue, tax caps actually offer the most relief to the highest earners. While we want to provide relief to those on the lower end of the income scale, we do not want to lose the ability to capture revenue from those who are purchasing luxury/multiple homes in Teton County. A cap on property tax would only further incentivize those seeking tax shelters to purchase property in Wyoming.

What about basing property tax assessments on acquisition value, or the sale price of a home?

Please refer to this article for that information, as the Wyoming legislature hired consultants to explore this idea. The consultants determined that an acquisition-based property tax system would be unconstitutional and present revenue issues for the state.

GENERAL TIMELINE

2023

- 3/2/23: Governor Gordon signs House Bill 99 which enables more Wyomingites to qualify for tax relief

- 3/3: Governor signs Senate Joint Resolution 3, which will bring a constitutional amendment to the ballot in 2024 that would allow the creation new classes of property tax

- 6/26: State Revenue Committee meeting about property tax reform (local Representatives Byron and Storer are on this committee)

- 10/4: Report determines that Teton County nets highest property tax relief in the state

- Joint Revenue Committee votes against bill draft that would set property tax assessment on acquisition value

2024

- Four property tax bills pass in the Wyoming legislature: HB3, HB4, HB45, and HB89; see details below

- November: the constitutional amendment passes, paving the way for expanded options for tax reform in the future.

2025

- March: SF 69 passes, exempting the first 25% of the value of a home from property tax.

LATEST PROPERTY TAX RELIEF INFORMATION provided by the Dept. of Revenue

HB0003 Property tax exemption for long-term homeowners: not in effect until January 1, 2025

- Available for a property owner/spouse that is 65 and older and has paid residential property taxes for 25 years or more in Wyoming. A surviving spouse of a person that qualified shall continue to qualify for the exemption.

- Does property need to be a primary residence? Yes; must reside in the primary residence for not less than 8 months of a year.

Application: This law requires the owner to submit a claim to the County Assessor no later than the 4th Monday in May. False claims are punishable as provided by W.S. 6-5-303

Tax relief granted:

- 50% exemption of assessed value for residential structure and up to 35 acres associated residential land when the land is owned by the owner of the dwelling.

- Department of Revenue must promulgate rules to include the application no later than Dec 2024.

- The legislature does not “backfill”. All taxing authorities will see a reduction in their assessed value.

- This statute is repealed July 2027. The exemption is available for tax years 2025 & 2026.

HB0004 Property Tax Refund Program: Effective immediately.

- Homeowners must have been a Wyoming resident for the past five years; no age requirement

- Paid 2023 Property Taxes on that home and have a receipt

- Occupied the residence for not less than 9 months of the tax year

- Your total personal assets do not exceed $156,900 per adult household member. In other words, if you own other real estate, bank accounts and investments, they cannot value in excess of $156,900 per adult household member. However, you may exclude the value of your home, a car for each adult household member, and any retirement accounts (IRA’s, 401K plans, cash value of life insurance policies, Medical Savings, etc.) or your total property tax bill exceeds more than 10% of your total reported income then the asset limit would not apply.

- If household income is equal to or less than 145% of the median household income for the county in which you reside or the statewide median, whichever is greater.

- Does property need to be a primary residence? Yes; this program requires Wyoming residency for the past 5 years and they occupy the residence for not less than 9 months of the tax year.Application: This law requires the applicant to submit the application and necessary documentation to the Department of Revenue or County Treasurer by the first Monday in June. All refund checks must be processed by September 30th. Beginning 4-15-2024, Taxpayers may apply for tax year 2023 refunds online at https://wptrs.wyo.gov/

- County Option Property Tax Refund deadline for application moved from first Monday in September to second Monday in October.

HB0045 Property Tax Exemption-Residential Structures and Land: Effective immediately

- For the 2024 tax year, all single family residential structures intended for human habitation including a house, modular home, mobile home, townhouse, or condominium that is privately owned single family dwelling unit.

- For the 2025 tax year, all of the above and improved associated land.

- Exemption does not apply if the owner acquired the property during the prior calendar year or;the residential structure is new construction or has added an addition to an existing structure.

- No age requirement.

- Does property need to be a primary residence? No, but it must be a single family residential structure; no occupancy length requirement.Application: No application is required. If applicable, the exemption will be noted on the 2024 assessment schedules that are mailed by county assessors no later than the 4th Monday in April. The legislature does not “backfill”. All taxing entities will see a reduction in their assessed value.

SF0089 Veterans ad valorem exemption-amount: This law is not in effect until 2025

- Available for honorably discharged veterans of WWI, WWII, Korea, Vietnam, or honorably discharged veteran who was awarded the armed forces expeditionary medal or other authorized service or campaign medal indicating service for the United States in any armed conflict in a foreign country (Qualified Medals); surviving spouses of qualifying veterans; certain disabled veterans may be eligible for the exemption. Also, the veteran must own the residential property.

- The veteran must have been a Wyoming resident for 3 consecutive years before filing a claim.

- Surviving spouses also qualify if they do not remarry.

- No age requirement.

- Does property need to be a primary residence? Yes, and applicant must reside in the residence for more than 6 months per year.Application: The veteran must file a claim with the County Assessor by the 4th Monday in May. However, if the veteran is discharged after the 4th Monday in May, he can still file a claim for the current tax year.Changes to this exemption from the 2024 Legislative Budget Session: Current law is $3,000 assessed dollar exemption or approximately $220 tax dollars. Effective January 1, 2025 the new amount of $6,000 assessed dollars or approximately $440 tax dollars will be exempted.See wyoleg.gov for more information.

Last updated 3/15/25